This article was written by Luca Scacchi and was published in Italian in the ControVento magazine (n° 3, October 2023). It was closed for editing on September 18, 2023. Reposted from ControVento website.

Chinese capitalism and its emerging imperialistic tendencies.

The more than 2,000 delegates attending the 20th Congress of the Chinese Communist Party have, in their own way, contributed to making history [October 16-22, 2022]. There has been significant media attention surrounding a side incident, seen as either amusing or dramatic depending on one’s perspective. During the final session, just before the vote, the eighty-year-old Hu Jintao [Secretary from 2002-2012] was assisted, pulled up, and escorted out. The deputy editor of Foreign Policy interpreted the event politically, suggesting a deliberate attempt to humiliate him, aiming to weaken and sideline the previous leadership. The Economist considered it more likely that Hu was experiencing mental confusion associated with his age.

The congress, nonetheless, was characterized by an amendment to the Party’s Charter [Zhōngguó Gòngchǎndǎng Zhāngchéng], encompassing approximately fifty articles that addressed program, organization, discipline, and symbols. Specifically, this amendment incorporated the so-called Two Stabilities [Liǎng Gè Quèlì] and Two Safeguards [Liǎng Gè Wéihù], outlined in the resolution Main Achievements and Historical Experiences of the Party in the Last Century [CC of November 8-11, 2021]. These principles establish the unequivocal supremacy of Xi Jinping. They enshrine Comrade Xi Jinping’s status as the core of the Central Committee and the entire Party, affirming the leading role of Xi Jinping’s ideology. They safeguard the party core status of General Secretary Xi Jinping and uphold the centralized authority of the Party. This preeminence translated into the subsequent day’s elections of the Politburo, its Standing Committee, and the General Secretary.

Xi Jinping was indeed granted a third five-year term, departing from the practices established by Deng Xiaoping in the 1980s to prevent a reoccurrence of Mao’s excesses, ensure the stability of the system, and manage succession. In March 2018 the National People’s Congress had already abolished the two-term limit for the President of the Republic, the only formal constraint. The 20th Congress marked a further step, undermining the principle of intra-party democracy that had governed the collective leadership for the past forty years, ensuring representation of major informal currents of the Party. In the approved Report, unlike usual practice, the principle is only briefly mentioned towards the end of the text. Most notably, the new Standing Committee witnessed the exclusion of 4 out of the previous 7 members: Li Keqiang, the outgoing Prime Minister and a protege of Hu Jintao, leading the Tuanpai faction from the Youth League; Han Zheng, associated with the so-called Shanghai clique once led by Jiang Zemin; the pro-market reformist Wang Yang, previously considered as one of Xi’s potential successors; Li Zhanshu, an ally of Xi but now aged 72. In their stead, four members of the Xi’s clique [the so-called Zhījiāng Xīnjūn, Zhijiang New Army] became part of China’s actual governing body: Li Qiang, the new premier [his close aide in the early 2000s, former Shanghai secretary, notably lacking regional experience]; Cai Qi, Ding Xuexiang, and Li Xi. They joined the existing members Zhao Leji [heading the anti-corruption campaign, pivotal in the purges] and Wang Huning [the political theorist credited with formulating Zemin’s Three Represents, Hu’s Scientific Outlook on Development, and notably Xi’s Chinese Dream]. In other words, all members of the Standing Committee are now part of Xi’s faction. A solution that hasn’t prevented new purges, both in the government [Qi Gang and Li Shangfu, foreign and defense ministers] and in the military [General Li Yuchao and his deputy Liu Guangbi, at the helm of the Missile Forces].

A new authoritarian power unfolds, after the prolonged Dengist equilibrium, during which rules and practices had evolved to ensure a controlled development of productive forces. Over the past few years, it has undertaken a restrictive shift, carrying out widespread purges under the pretext of an anti-corruption campaign. According to estimates from Li & Manion [The Decline of Factions, BJPS, 2023, 53, p. 815–834], approximately 1.5 million officials have been targeted since 2012. Among them are hundreds of thousands of lower-level officials (flies) and high-profile figures (tigers) such as Bo Xilai, once considered a potential alternative to Xi; Zhou Yongkang, in charge of security; Sun Lijun, a deputy minister who played a significant role in law enforcement (overseeing the crackdown on Falun Gong); Xu Caihou, deputy of the Central Military Commission, holding the highest position for a general.

This authoritarian leadership has cultivated a distinct nationalist profile, underpinned by a rearmament policy and an expansionist agenda. In terms of military advancements, the army’s emphasis has shifted towards enhancing new projection capabilities: this is evidenced by the upgraded air and missile forces and the ongoing development of an oceanic Navy, focused on three aircraft carriers [Liaoning, Shandong, and Fujian] alongside a fleet of over sixty submarines [including the new nuclear Type 095, expected to be launched next year]. On the economic front, the Belt and Road Initiative [commonly known as the New Silk Roads] has driven the development of commercial zones and the surge in capital exports from China. One might assume that these actions arise from subjective inclinations and discretionary choices of a specific leadership. Or one might assume that these actions are a direct response to the escalating US aggression [NATO expansion in Europe, commercial and military alliances such as TPP, AUKUS, Indo-Pacific axis], occurring simultaneously with the gradual erosion of its superpower [2006/08 crisis, defeats in the Middle Eastern wars, loss of control of South America, etc]. These perspectives would confine us to a world where individual intentions or geopolitical dynamics determine events. It is crucial to note that Xi Jinping’s authoritarian and nationalist traits have not been isolated factors. Instead, specific structural changes have stimulated and driven these policies, subjectively interpreted, and pursued by Xi and his leadership. Essentially, what we aim to point out here is that China has developed inherent structural tendencies toward imperialism.

What do we mean by imperialism? To argue this thesis, we must first delve into the meaning of this term. The debate that unfolded in the early 1900s (Parvus, Hobson, Hilferding, Luxemburg, Kautsky, Bucharin, Lenin, and Trotsky) emphasizes that imperialism is not merely a policy of power. The expansion of a country isn’t propelled solely by the decisions of its ruling classes or as a reaction to other powers. In fact, imperialism isn’t the policy of a single country but rather the outcome of the world market structure within the context of the unequal and combined movement of the capitalist mode of production. This movement continually reshapes hierarchies in the global division of capital and labor. As Lenin summarized in his seminal work of 1916 [Imperialism, the Highest Stage of Capitalism“, Chapter VII], its definition hinges on five basic features: 1. the concentration of production and capital, reaching such a high stage that it has created monopolies which play a decisive role in economic life; 2. the merging of bank capital with industrial capital, and the creation, on the basis of this “finance capital,” of a financial oligarchy; 3. the export of capital as distinguished from the export of commodities acquires exceptional importance; 4 the formation of international monopolist capitalist associations which share the world among themselves; 5. the territorial division of the whole world among the biggest capitalist powers is completed. Imperialism is capitalism at that stage of development at which the dominance of monopolies and finance capital is established; in which the export of capital has acquired pronounced importance; in which the division of the world among the international trusts has begun, in which the division of all territories of the globe among the biggest capitalist powers has been completed. This analysis marks a pivotal juncture in his political and theoretical trajectory: it led him to formulate the astonishingly [primarily within his party] April Theses of 1917. These theses, notoriously, advocated for a socialist revolution grounded in Councils, diverging from a workers’ and peasants’ dictatorship with democratic objectives [the classical approach of the Bolsheviks]. This path was instigated by Bucharin [Imperialism and World Economy, 1915], who underscored the state’s role in competitive processes and the imperative for its overturning in an imperialist phase: proletarian policies couldn’t effectively guide a capitalist state, as monopolistic development would shape its apparatus. Initially, Lenin accused him of anarchism, but as the war progressed, he adopted a new perspective. I believe these five points aren’t simply a formula; rather, they outline a capitalistic drive that influences not only the policies of ruling classes but also shapes the fundamental structures of states. An imperialist country, therefore, is one in which the unequal and combined dynamics of the world market [the advantage of backwardness and the whip of external necessity] matures concentration, monopolies, and financial capital, leading to substantial capital exports and thereby conflicting with other imperialisms.

Can it be asserted that this depicts the reality of China? To respond, it’s necessary to take a step back. For the development of imperialist tendencies, the foremost requirement is to cultivate an accumulation of capital of such significance as to establish monopolies holding a decisive role in economic life. Does this circumstance exist in contemporary China?

The People’s Republic of China was established on October 1, 1949, during a period of prevailing Stalinism. Mao delineated the Republic within the framework of New Democracy [Xīn Mínzhǔ Zhǔyì], a phase intended to develop productive forces led by the Chinese Communist Party (CCP) within a Bloc of Four Classes: workers, peasants, the petty bourgeoisie, and progressive-nationalist segments of the bourgeoisie. Despite the existence of red zones during the protracted people’s war and the anti-Japanese resistance, Communist China did not aim to eradicate capitalist modes of production but sought to regulate them within the context of a broad interclass alliance, serving an anti-colonial and anti-imperialist function. The turning point came in the following years. The policies of collectivization were gradually introduced in the 1950s, initially commencing with land reforms [so-called small leap forward]. The Hundred Flowers Campaign [1956], initiated by Mao to provoke cultural, political, economic, and social liberalization, there ensued the crackdown of the Anti-Rightist Campaign [1957], aimed at suppressing advocates of capitalism. This was succeeded by the Great Leap Forward [1958/61], characterized by a forced and extensive collectivization across the country, a phase that endured throughout the Cultural Revolution [triggered by Mao’s bid to regain control after being ousted from the Headquarters by the right-wing faction led by Liu Shaoqi and Deng Xiaoping]. The extensive repression in the early ’70s [under the auspices of the People’s Liberation Army] and the intense factional struggle culminated in the definitive marginalization of the so-called Gang of Four. Deng’s return initiated a process of de-collectivization [dissolution of agricultural communes], which, throughout the 1980s, expanded to the Special Economic Zones and, in the 1990s, encompassed the entire country, ushering in market-oriented policies across all sectors.

The 1980s marked the beginning of an unprecedented era of growth in China, characterized by its unparalleled magnitude and speed. China’s GDP experienced continuous expansion without any recessions: often recording growth rates surpassing 10%, only falling below 5% on two occasions [in 1989 and 1990 due to Tiananmen; in 2021 and 2022 due to the pandemic]. According to the IMF, in 1980, China’s GDP stood at around $300 billion, ranking 7th globally, lower than Italy’s approximately $480 billion, West Germany’s $850 billion, Japan’s over $1.1 trillion, and the USA’s $2.85 trillion. As of 2023, China’s estimated GDP stands at $19.37 trillion, ranking 2nd globally after the USA’s $26.85 trillion, surpassing the EU’s $17.82 trillion. China’s GDP stands significantly apart from Japan’s approximately $4.41 trillion, Germany’s $4.3 trillion, India’s $3.74 trillion, the United Kingdom’s $3.17 trillion, and Italy’s $2.17 trillion. China stands as the world’s leading exporter, accounting for 14.7% of global exports, surpassing the USA’s 8.1% and Germany’s 7.8%. It holds the position of the foremost industrial power, with its share of global production nearly double that of the USA (28% compared to 16%). In 2022, it produced 52% of the world’s steel output (1 billion tons); 47% of ships (55% of new orders; over 36 million tons, exceeding South Korea’s 23 million tons and Japan’s 15 million tons); 54.5% of computers; over 30% of electricity (8.8 TWh, compared to 4.5 TWh in the USA), and 34% of automobiles (although the leading Chinese producer, Changan, ranks tenth with 2.3 million vehicles). In essence, it is indisputably the world’s factory.

Some argue that despite the undeniable presence of private capital and significant integration into the global market, this remarkable development is still framed within a socialized economy. In our view, it’s crucial to observe the actual reality. The production of goods, the exploitation of labor, and the accumulation of capital have become dominant. Yes, the State plays a substantial role in certain sectors, like in the developmental trajectories of other capitalist countries (Japan, Germany, and even Italy). Nevertheless, all enterprises operate within the market sphere with the primary aim of generating profits by extracting absolute and relative surplus value, irrespective of public or private ownership.

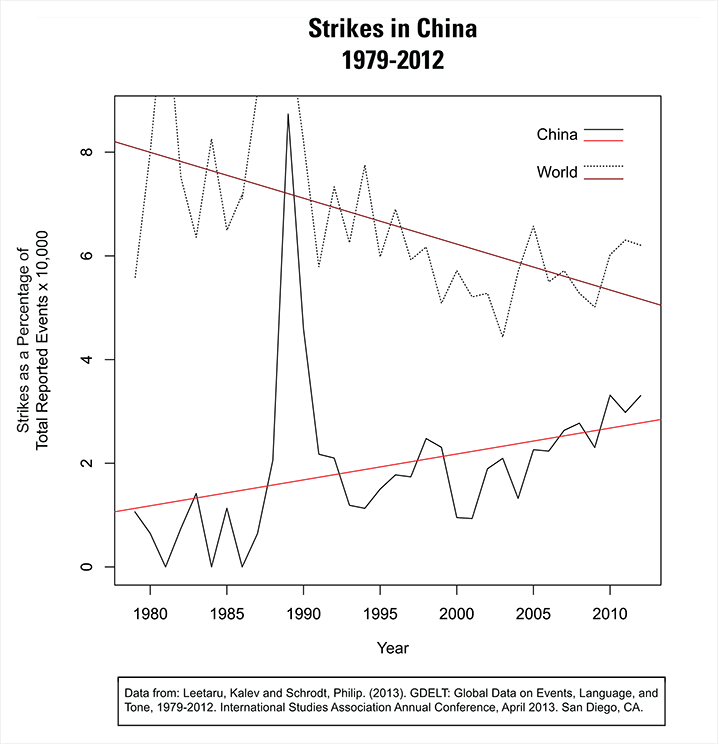

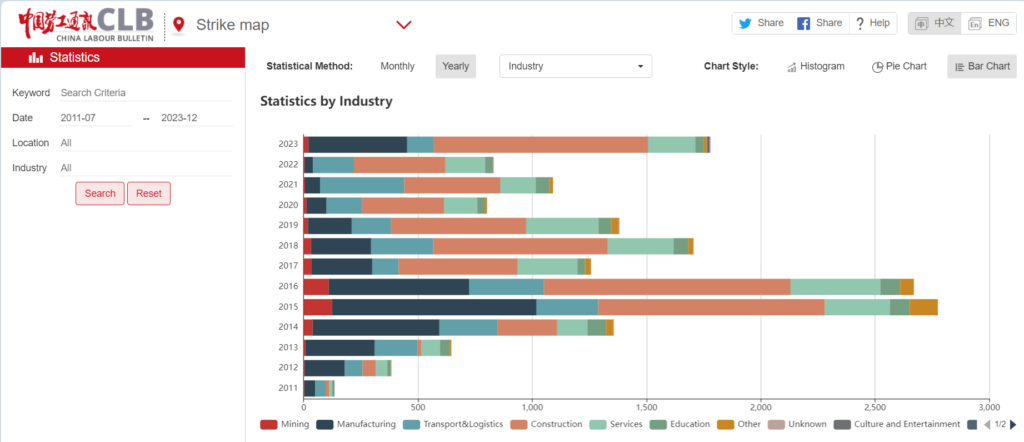

The most direct evidence of a capitalist mode of production lies in the emergence of class struggle within production relationships. Conflicts regarding wages, working hours, and rights, extending beyond the peak of 1989 (Tiananmen, supported by a mass movement that impacted the entirety of China). They have progressively intensified during the 1990s and 2000s, particularly in the construction and manufacturing sectors. These confrontations are frequently instigated by a migrant proletariat [Mingong], newly arrived from rural areas and concentrated along the coasts. The forms of protest are diverse, encompassing strikes [Ba Gong], sit-ins [Jing Zuo], demonstrations [You Xing], and roadblocks [Zu Lu]. According to Pandey’s analysis [Labour Unrest in China and the Foreboding, Center for Security Studies, 4.10.2010], industrial conflicts escalated from 10,000 in 1993 to 317,000 in 2009, with the number of participants rising from 700,000 to over 5.4 million. A significant turning point occurred in 2010, marked by a wave of suicides in Foxconn dormitories and a 19-day strike at the Honda Nanhai plant in Foshan. Both incidents were attributed to the intense work pace and low wages.

If we aim to identify a pivotal date for the ascendancy of this capitalist transition, it undoubtedly points to 2001, when the country acceded to the WTO, marking its complete integration into the global market. The influence of state-owned enterprises notably dwindled, plummeting from 50% in the early 1990s to 25% by 2008. By 2011, approximately 253 million Chinese workers were employed in the private sector, comprising 70% of the urban workforce. It’s within this backdrop that the theory of the Three Represents [Sān gè dàibiǎo, 2000] emerged. This theory entrusted the party with the duty of ensuring the development trend of China’s advanced productive forces, guiding the direction of China’s advanced culture and protecting the fundamental interests of the overwhelming majority of the Chinese people. Essentially, the party explicitly undertook the role of representing all productive forces within the ongoing landscape of capitalist competition.

The transition to a capitalist mode of production in China happened without any significant political or institutional break. Even during the recent Internationalist Conference in Milan, we emphasized the perplexity felt by those with a revolutionary communist outlook, with a Trotskyist tradition, questioning how this transformation occurred. Specifically, how a distorted workers’ state managed to undergo a robust capitalist development without a counter-revolutionary upheaval, as was the case in the Soviet Union in 1991. A couple of years ago, I underscored [USA and CHINA: Alignments and Competitions, in italian] how certain historians [such as Gray, Allison, Anievas, and proponents of the Uneven and Combined Development school] theorize that the bureaucratic apparatus, leveraging its relative autonomy, took on the responsibility of safeguarding emerging national capital in the global arena. This involved controlling the working class and mediating among different factions of capital. Essentially, the CCP assumed the task of orchestrating a passive revolution and adopted a Bonapartist role in both modes of production. A role similar to that played by other independent social groups and classes (distinct from the bourgeoisie) in certain historical transitions: for instance, the Junkers in Germany or the Satchō Alliance in Japan (a military coalition between the feudal domains of Satsuma and Chōshū in the South of the country). This is an important discussion that certainly warrants further exploration, although it isn’t the primary focus of today’s reflection.

Capitalist development in a vast country like China doesn’t automatically imply a shift towards an imperialist projection. The substantial disparities and low income could categorize it as a nation within a moderate capitalist spectrum. GDP per capita still around $13,700, significantly distant from the $80,000 in the USA or $36,000 in Italy, firmly placing it within the medium-income country range. The Chinese economy still bears significant contradictions between socialized sectors and a frail bourgeoisie, potentially functioning as a comprador (subservient to foreign capitals). These features could make China a newly developing country, still vulnerable to the influence or subordination of global imperialisms. This subjugation could be facilitated by its role as the world’s factory, deeply integrated into international value chains under foreign control (i.e., we can see Apple and the ultimate destination of a significant portion of profits originating from its Asian production). Hence, China is perceived by several internationalist revolutionary sectors as a country in transition, lacking a stable capitalist structure, due to the absence of an explicit counter-revolution. A country still susceptible to division among dominant imperial powers (such as the USA and its allies).

Steven Rolf [autor of China’s Uneven and Combined Development, Palgrave, 2021] acknowledges that during the initial phase of Chinese development (the era of reforms and openness), regional and local party cadres played a fundamental role in engaging with international investors. They aimed to capture market shares through competitive pricing. In practice, a strategy emphasizing export-driven accumulation was devised in coastal provinces: a model of extensive economic growth reliant on low wages and the extension of working hours. This strategy interlinked with the neoliberal phase of internationalization and intensified exploitation under the umbrella of the so-called Washington Consensus. This external whip stimulated this production network and, simultaneously, facilitated its rapid advancement. Consequently, in 1994, exports contributed to 18% of the GDP and foreign capital constituted 17% of fixed investments in China, 87% in coastal cities, establishing their dependency on export-oriented manufacturing. By 2000, one-third of the GDP originated from Foreign Direct Investments, reaching a peak close to 40% in 2006. Hence, under China’s broad autonomies, certain segments of the provincial bureaucracy had effectively taken on the role of a comprador bourgeoisie. Nevertheless, according to Rolf, a different equilibrium emerged at the central level within the framework of intra-party democracy, incorporating influences from interior and northern provinces, major state-owned enterprises, the military, and the central structures of the CCP. In practice, the CCP maintained its national and bonapartist profile. The accession to the WTO, the conclusive step toward integration into global markets, acted as a new external whip, instigating a novel and profound productive restructuring. This involved implementing new protectionist policies (i. e., automotive industry) and significant restructurings of state-owned enterprises, fostering increased productivity and heightened competitiveness among its key players. This perspective aligns with the Scientific Outlook on Development [Kēxué Fāzhǎn Guān] by Hu Jintao, outlining a new model of sustainable development aimed at creating a harmonious society, reducing the gap between provinces. In this model, the government and the Party emphasize overall planning and coordinate internal state relations from a national standpoint. As indicated by Rolf, those years witnessed a genuine economic leap, wherein the central state regained control over dominant financial and industrial nodes. During that period, two distinct accumulation strategies emerged: one in the coastal provinces and another centrally oriented (one geared towards exports and the other focused on the development of national capital). These two strategies have been harmonized amidst tensions and contradictions into a unified national policy, steering manufacturing towards high-tech and value-added sectors.

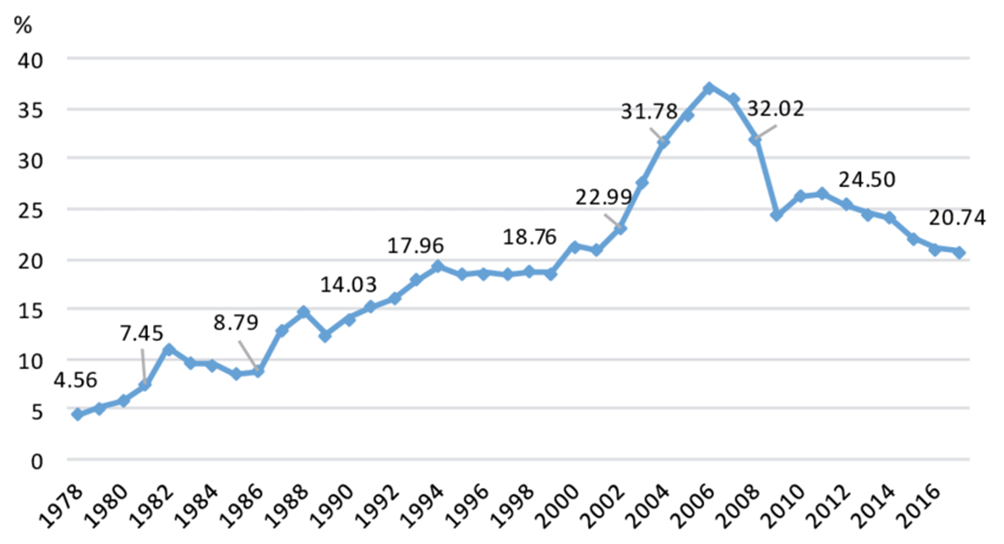

The tipping point was the Great Crisis. The global recession, primarily affecting the Atlantic markets (USA and EU), also struck China. Between 2007 and 2012, the trade surplus plummeted from 10% to 2% of the GDP, resulting in roughly 30 million workers unemployed. Although China managed to evade a recession, it set off a different growth trajectory, fluctuating between 6% and 8% [the new norm]. Discussions lingered for a significant period about redirecting accumulation strategies towards domestic demand. The hypothesis aimed to lead to the implementation of neo-Keynesian models in China, to boost wages and establish a social system that could offset the decrease in exports by stimulating internal public and private demand. Despite wage increments and improved social protection, this transition remained largely theoretical. The globally dominant capitalist crisis management adopted familiar policies on a broader scale, including low interest rates, high liquidity, and the growth of financial markets. These measures were directly supported by public intervention from central banks or state budgets. At a global level, wages bore the pressure to uphold high levels of profitability in a production environment often stagnant, if not in decline. Thus, the strategy focused on developing the domestic market has had to contend with profitability and international competition. Once again, the whip of external necessity prompted a shift, centering on increased public infrastructure investments: a Keynesian approach of public spending serving the accumulation of capital.

To counter the economic downturn, the Chinese Communist Party intervened with an extraordinary economic stimulus, injecting over $700 billion. Most of these funds were directed toward fixed investments and a significant geographic reorientation, focusing on expanding the economy inland. Fixed investments reached a peak of 48% of the GDP in 2011 and remained consistently above 45% for an extended period, a stark contrast to the late-stage capitalist countries’ average of 20%. This substantial influx of resources supported the growth of prominent industries, such as steel and ship production, city and port construction, and the establishment of an extensive high-speed rail network. China currently operates a high-speed rail network covering 42,000 kilometers, with an additional 28,000 kilometers under construction, exceeding the combined total of just over 20,000 kilometers in the rest of the world. Consequently, the contribution of exports to the GDP declined to around 20%, while the focus shifted toward fixed investments.

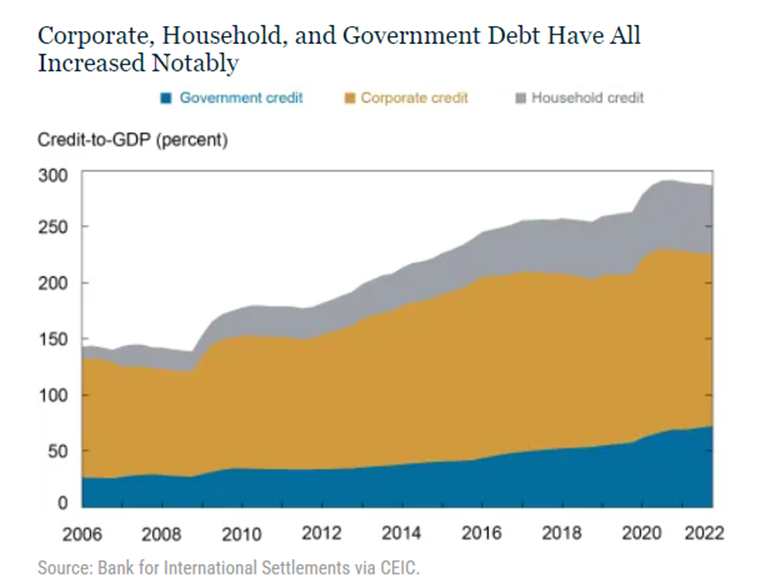

In this context, a robust financial market flourished over the last two decades. The stock market, based in Shanghai, Shenzhen, and Hong Kong, experienced substantial expansion. China’s global debt increased from 150% of the GDP in 2005 to 250% in 2019. In 2020, China witnessed a further surge in its debt levels as the government responded to the severe economic slowdown caused by the COVID-19 pandemic. This expansion was primarily due to the growth in corporate debt and notably, in recent years, household debt. Throughout China’s rapid urbanization phase, particularly in recent years, this financial market has thrived due to extensive speculation in land and construction (real estate). As a result, the Chinese domestic bond market is currently estimated at around 13 trillion USD, ranking third globally after the US and Japan (CNBC, 2019). Notably, it encompasses a important portion represented by Urban Construction Investment Bonds (UCIB) or Chengtou Bonds, totaling 1.14 trillion USD (Wind, 2018).

According to Rolf [2021], this new normal phase is defined by a monopolistic accumulation strategy, emphasizing the emergence of substantial continental corporations supported by state-driven capitalism. Essentially, after the Great Crisis, this strategy became crucial in molding the Chinese model amidst the increasing global competition. It entailed a renewed public impetus to organize society and the economy, with the Made in China 2025 initiative. Significant Chinese monopolies have emerged over the past decade, demonstrating the capacity to engage in intense competition on a global scale. The Global Fortune 500 list of 2023, ranking companies by revenue, features 142 Chinese firms, surpassing the 136 American entities. Notably, nearly a hundred are European (including 30 German and 23 French), while 41 are Japanese. Among Italian companies, five secured positions: ENEL at 59th, ENI at 61st, Generali at 137th, Banca Intesa at 382nd, and Poste at 452nd (alongside Exor, the Agnelli’s holding, officially Dutch, at 317th). China boasts three entities within the top ten: State Grid (3rd, with a revenue of $530 billion), China National Petroleum (5th, with $483 billion), and Sinopec (6th, a petrochemical company generating $471 billion). Additionally, 17 Chinese corporations feature in the top 50, including China State Construction Engineering (13th, $305 billion), Industrial and Commercial Bank of China (28th, $214 billion), China Construction Bank (29th, $202 billion), Agricultural Bank of China (32nd, $187 billion), Ping An Insurance (33rd, $181 billion), Sinochem (38th, $173 billion), China Railway Engineering Group (39th, $171 billion), China National Offshore Oil (42nd, $164 billion), China Railway Construction (43rd, $163 billion), China Baowu Steel Group (43rd, $161 billion), and Bank of China (49th, $159 billion). Additionally, Hon Hai Precision Industry (27th, $222 billion, Taiwanese, commonly known as Foxconn) could be included in this list. These corporations have been central to recent trade disputes, such as Huawei (111th, $95 billion), which amazed markets by launching its new Mate Pro 60 smartphone, equipped with a Kirin 9000s microprocessor boasting 7-nanometer technology [an accomplishment deemed impossible by the US due to their embargo].

Chinese Export on GPD [IMF, 2018]

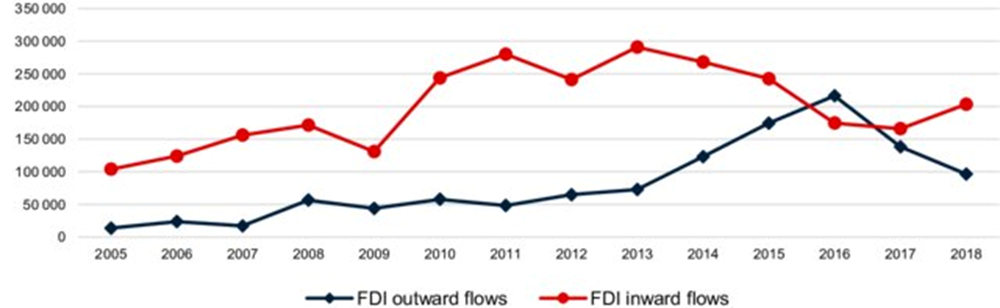

Consequently, this capital has extended its influence beyond national borders. This isn’t just an observation; concrete examples substantiate this trend, including Cosco’s acquisition of the Port of Piraeus, Sinochem’s acquisition of Pirelli [one of Italy’s primary chemical companies and a major global tire manufacturer], and State Grid’s significant holdings in the Italian electricity network. Chinese Foreign Direct Investments surged post-2008 and skyrocketed from 2011, surpassing foreign investments within their country by 2016. Yet, according to ISPI [an Italian think-thank of international political studies], the nature of these investments has evolved. While the commitments along the Belt and Road Initiative remain steadfast, there has been a decrease in acquisitions of competing companies. Instead, new enterprises (greenfield investments) have gained prominence due to facing fewer authorizations and controls. The primarily infrastructure and finance-oriented Chinese capital now seeks greater global expansion, supported by political and economic safeguarding from its state, amid heightened competition among other imperialist nations.

[OECD 2019)

This constitutes the foundational structure underpinning Chinese imperialist expansion. When we examine Lenin’s features, they all align here. The impetus behind Xi Jinping’s shift towards nationalism and authoritarianism stems from the competitive expansion of Chinese capital, driving investments in Asia, Latin America, and Africa, as well as steering the Belt and Road Initiative. This force propelled the inception of the Asian Infrastructure Investment Bank (AIIB) in 2014, the establishment of the Regional Comprehensive Economic Partnership with 15 Pacific countries (as a counter to the American TPP), the gradual growth of the Shanghai Cooperation Organization (a military alliance for Asian security), and most recently, the extension of BRICS to encompass Arab, African, and South American nations.

Here looms the dragon’s shadow, its burgeoning imperialist influence on the global stage. However, this growth is riddled with imbalances and contradictions, within a lingering depressive phase following the Great Crisis and specific vulnerabilities such as territorial imbalances, the recent failures of the real estate market, and the ongoing aging of the population. The trajectory of these contradictions and the potential emergence of an unprecedented and potentially devastating Chinese recession remain uncertain. Nevertheless, history shows that the prolonged American Depression in the 1930s did not impede its imperialist ascent. In this new era characterized by an imperialism of attrition, China stands out as one of the prominent actors.